Surplus lines homeowners insurance refers to insurance coverage provided by non-admitted or surplus lines insurers. These insurers specialize in offering coverage in situations where traditional admitted insurance companies might not provide insurance, often due to the higher risk associated with the property or the owner.

Key aspects of surplus lines homeowners insurance include:

- Non-Admitted Insurers: Surplus lines insurers are not licensed by the state but are allowed to operate on a surplus lines basis. They are subject to less regulation compared to admitted insurers, which can provide more flexibility in terms of the types of risks they can insure. This lack of regulation allows the “no’s” to stop and logic and reason can kick in.

- Unique or High-Risk Situations: This type of insurance is typically sought for properties that are considered too risky for standard insurers. This can include homes in areas prone to natural disasters, properties with unique construction, or homes with a history of many claims.

- Customized Coverage: Surplus lines insurance policies are often more customizable than standard policies, allowing for more tailored coverage to meet specific needs and risks.

- State Surplus Lines Offices: Each state in the U.S. has a surplus lines office that oversees these insurers. While they are not licensed by the state, they are still subject to oversight and must meet certain financial requirements.

- Premiums and Protection: Due to the higher risk associated with the properties they insure, surplus lines insurers may charge higher premiums.

Surplus lines home coverage can sometimes be the answer that people need, particularly in situations where traditional insurance companies are unable or unwilling to provide coverage. Here are some scenarios where surplus lines insurance might be necessary or beneficial:

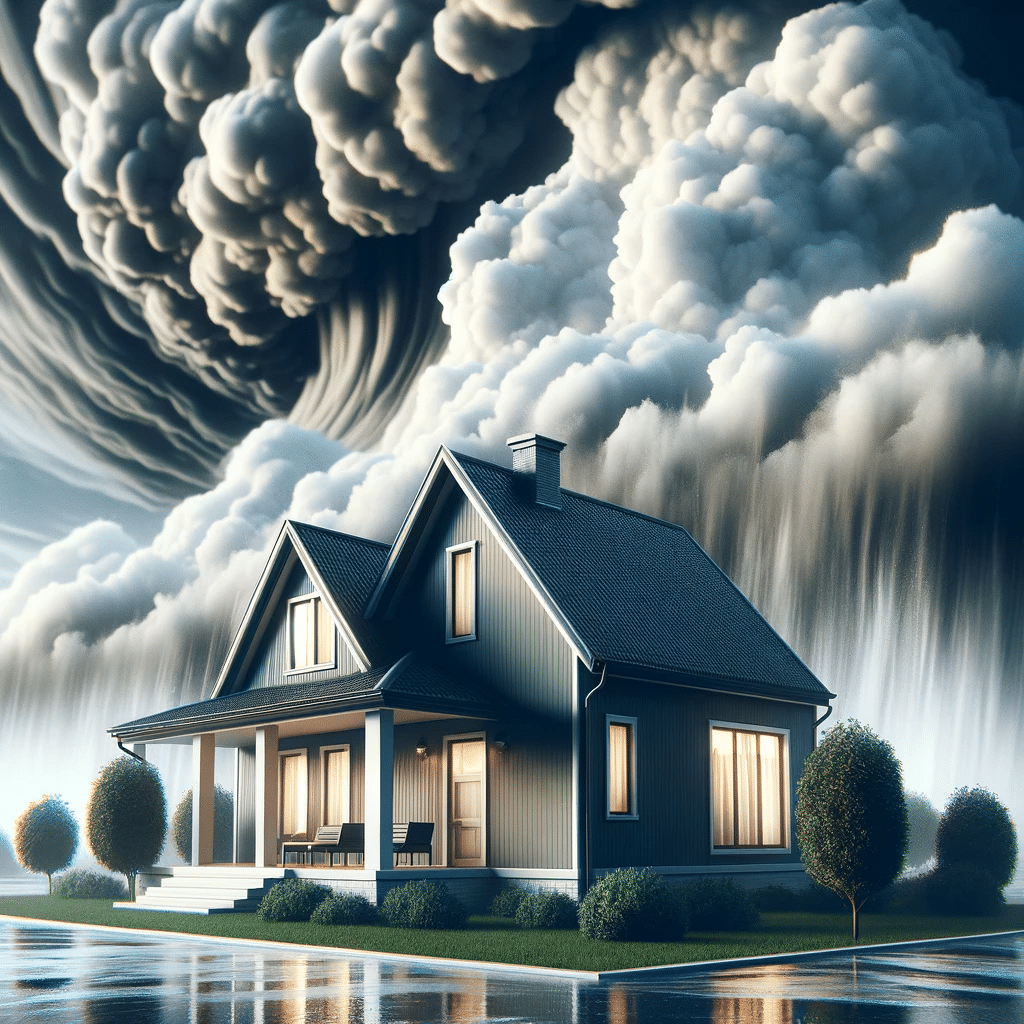

- High-Risk Properties: Homes in areas prone to natural disasters like floods, earthquakes, or hurricanes might be considered too high-risk for standard insurers. Surplus lines insurers often provide coverage for such properties.

- Unique or Unusual Homes: Properties with unique architectural features, historical significance, or non-standard construction materials may not fit the underwriting criteria of standard insurance companies. Surplus lines insurance can offer tailored coverage for these unique homes.

- Poor Claims History: Homeowners with a history of multiple insurance claims may find it difficult to obtain coverage from standard insurers. Surplus lines insurers might be more willing to take on this risk, albeit often at a higher premium.

- Lapse in Coverage: If a homeowner has had a lapse in their insurance coverage, standard insurers might view them as high-risk. Surplus lines insurers can provide a solution in such cases.

- High-Value Properties: Homes with very high values or expensive contents might exceed the limits of what standard insurers are willing to cover. Surplus lines insurers often have more flexibility in insuring high-value properties.

- Vacant or Unoccupied Homes: Standard insurers typically have restrictions or won’t cover homes that are vacant or unoccupied for extended periods. Surplus lines insurers can offer specialized policies for these situations.

While surplus lines homeowners insurance can provide coverage when standard insurance is not available, it’s important to remember that it often comes with higher premiums and different terms and conditions. Additionally, since surplus lines insurers are not backed by state guaranty funds, there’s a higher risk for policyholders if the insurer becomes insolvent. Therefore, it’s crucial for homeowners to carefully evaluate their needs, understand the terms of the policy, and consult with insurance professionals to ensure they are making an informed decision.