Hurricane Season 2024: How prepared is your homeowner insurance?

Are you prepared for Hurricane Season 2024?

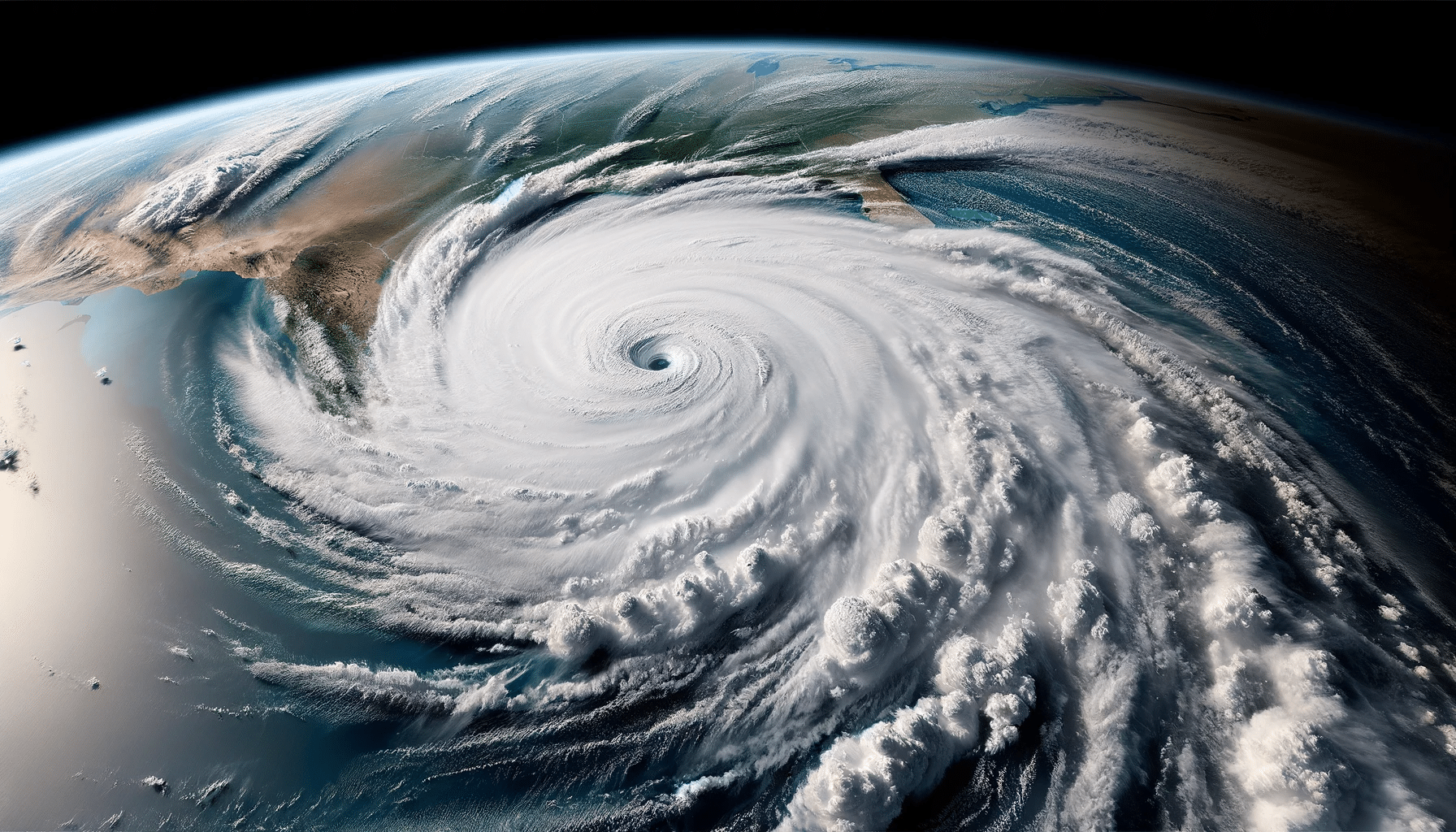

As June 1st marks the beginning of the 2024 hurricane season, coastal communities and meteorologists alike are gearing up for what could be a turbulent few months. Homeowners in high-risk areas must pay special attention to their insurance policies, ensuring they have adequate coverage for potential damages. Spanning from June 1st to November 30th, this period is crucial for regions along the Atlantic and Gulf coasts, where hurricanes and tropical storms can wreak havoc.

Historical Context and Significance of High-Risk Homeowners Insurance

Hurricane season is a time of heightened vigilance and preparedness, drawing attention to the potential for destructive weather patterns. Historically, some of the most devastating hurricanes, such as Katrina (2005) and Maria (2017), have occurred during these months, leaving lasting impacts on infrastructure, economies, and communities. The 2024 season is no exception, with advanced forecasting techniques providing insights into potential storm activities.

Predictions for 2024 Hurricane Season and High-Risk Homeowners Insurance

Meteorologists and climate scientists use a combination of historical data, current weather patterns, and advanced modeling techniques to predict the intensity and frequency of hurricanes each season. For 2024, the National Oceanic and Atmospheric Administration (NOAA) has forecasted an above-average season, with an estimated 14-20 named storms, 7-11 hurricanes, and 3-5 major hurricanes (Category 3 or higher).

Several factors contribute to this prediction:

- El Niño/La Niña Conditions: The presence or absence of these climatic phenomena significantly influences hurricane activity. For 2024, a weak El Niño is expected, which typically suppresses Atlantic hurricane activity. However, other atmospheric conditions may offset this effect.

- Sea Surface Temperatures: Warmer than average sea surface temperatures in the Atlantic Ocean and the Gulf of Mexico provide more energy for storm formation and intensification.

- Atmospheric Patterns: Wind patterns and atmospheric stability also play a role in determining the likelihood of storm development. Favorable wind shear conditions can either inhibit or promote hurricane formation.

High-Risk Homeowners Insurance Considerations for Hurricane Season

Homeowners in hurricane-prone areas need to pay special attention to their insurance policies. High-risk homeowners insurance is crucial for protecting properties from the devastating impacts of hurricanes. Policies should be reviewed annually to ensure they cover the current replacement costs and potential damage scenarios. Key considerations include:

- Coverage Limits: Make sure your policy covers the full replacement cost of your home and personal belongings.

- Windstorm Deductibles: Understand the specific deductibles for windstorm damage, which can be higher than standard deductibles.

- Flood Insurance: Standard homeowners insurance policies typically do not cover flood damage. It is essential to purchase separate flood insurance if you live in a high-risk area.

- Policy Exclusions: Be aware of any exclusions or limitations in your policy that could affect your coverage.

Preparedness Measures for High-Risk Homeowners

With the potential for an active hurricane season, preparedness is paramount. Coastal residents are encouraged to take several steps to mitigate risks:

- Emergency Kits: Assemble kits with essential supplies, including non-perishable food, water, medications, flashlights, batteries, and first aid supplies.

- Evacuation Plans: Develop and practice evacuation routes and plans. Familiarize yourself with local shelters and have a plan for pets.

- Property Protection: Secure outdoor furniture, reinforce windows and doors, and ensure that roofs and other structures are in good condition to withstand high winds.

- Stay Informed: Keep up with weather forecasts and updates from trusted sources like the NOAA and local authorities. Sign up for emergency alerts and have a battery-operated radio on hand.

Impact and Response for High-Risk Homeowners

The impact of hurricanes can be widespread, affecting not just the immediate area of landfall but also causing flooding, power outages, and disruptions to transportation and supply chains. In 2024, emergency response agencies are better equipped than ever to handle these challenges, thanks to improved technology and coordination efforts.

Federal, state, and local governments, along with non-profit organizations, play critical roles in disaster response and recovery. Investments in infrastructure, community resilience programs, and public awareness campaigns are ongoing efforts to reduce the adverse effects of hurricanes.

Think you are prepared for hurricane season 2024?

As the 2024 hurricane season begins, vigilance, preparation, and informed responses are key to mitigating the impacts of these powerful natural events. While predicting the exact path and intensity of hurricanes remains a challenge, advancements in meteorology provide valuable warnings that can save lives and property. By staying prepared and ensuring high-risk homeowners insurance is up to date, communities can better weather the storms that may come their way.

Hurricane Season Table of Contents

Recent Posts

Claims Surge Amid Unusual 2024 Hurricane Season and What Does it Mean for High Risk Homeowners Insurance?

How is the season so far and what do higher temperatures have to do with it? That warm waters in the tropical Atlantic...

2024- Are Burglary Claims Still a High Risk?

Burglaries are a persistent threat to homeowners across the U.S., with over one million break-ins occurring annually. Even though burglary rates have decreased...

2024 Atlantic Hurricane Season Predictions

All Early Predictions Call for a Busy 2024 Atlantic Hurricane Season Forecasters are predicting an exceptionally active Atlantic hurricane season in 2024. The...