Is it Hard to get Homeowners Insurance After Getting Dropped

Getting homeowners insurance after being dropped by a previous insurer can be challenging, but it’s not impossible. The difficulty largely depends on the reasons you were dropped and your current circumstances. Here are some factors that could affect your ability to secure new homeowners insurance:

- Reason for Cancellation or Non-Renewal: If your previous insurer dropped you due to claims history, non-payment of premiums, or the condition of your property, new insurers might view you as a higher risk. Homeowners carriers are increasingly looking at a simple lapse in coverage as something that categorizes you as high-risk.

- Claims History: A history of many or large claims can make insurers hesitant to offer coverage, as they may view you as a high-risk client. However, if your claims were for uncontrollable events or if you’ve taken steps to mitigate future risks, this could be viewed more favorably than a negligent loss.

- Home Condition and Location: If your home is in a high-risk area (e.g., prone to natural disasters) or if it’s in poor condition, insurers might be reluctant to offer coverage. Making improvements to your home or taking steps to mitigate risks (like installing storm shutters in hurricane-prone areas) can help. Some carriers will offer roof exclusions, but they may be temporary and have strings attached.

- Credit Score: In many states, insurers use your credit score as one factor in determining your premiums and eligibility for coverage. A low credit score can make it harder to find affordable insurance.

- Shopping Around: It’s essential to shop around and compare quotes from different insurers. Some companies specialize in covering higher-risk properties or individuals, so while you might face higher premiums, you can likely find coverage.

- State FAIR Plans: If you’re unable to obtain insurance through the private market, you might be eligible for coverage through your state’s FAIR Plan (Fair Access to Insurance Requirements). FAIR Plans are state-mandated insurance pools designed to provide basic coverage for those who cannot get insurance elsewhere, though they often come at a higher cost. They are the homeowners insurance of last resort.

- Improving Your Profile: Taking steps to reduce your risk profile can help. This includes maintaining your home, updating critical systems (like roof, plumbing, electrical, and heating), and implementing safety measures (such as burglar alarms and fire suppression systems).

In summary, while finding homeowners insurance after being dropped can be more difficult, it’s usually possible by understanding the reasons behind the cancellation, improving your risk profile, and exploring all available options, including state-assisted plans and insurers specializing in higher-risk coverage.

Recent Posts

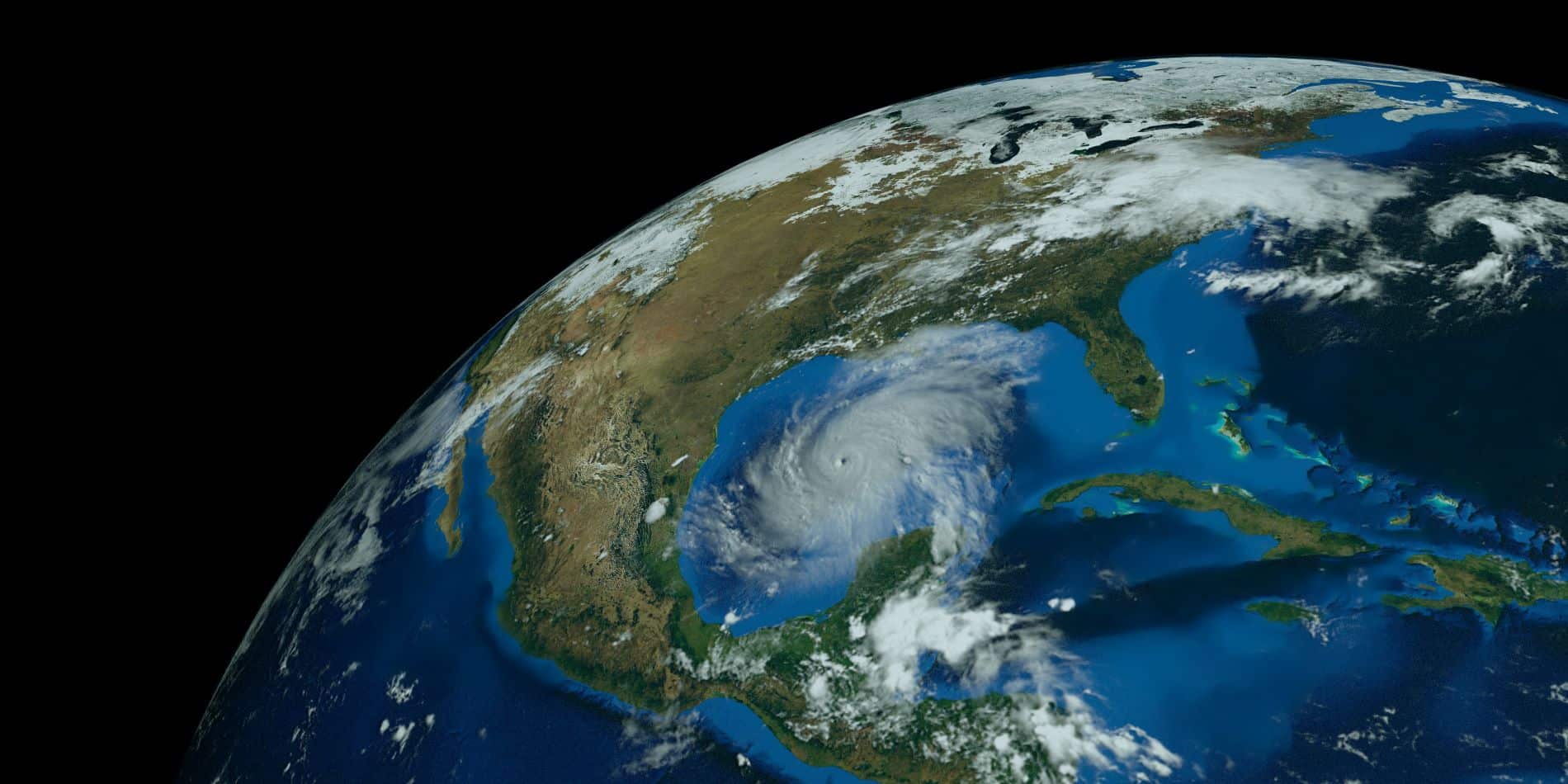

Claims Surge Amid Unusual 2024 Hurricane Season and What Does it Mean for High Risk Homeowners Insurance?

How is the season so far and what do higher temperatures have to do with it? That warm waters in the tropical Atlantic...

2024- Are Burglary Claims Still a High Risk?

Burglaries are a persistent threat to homeowners across the U.S., with over one million break-ins occurring annually. Even though burglary rates have decreased...

2024 Atlantic Hurricane Season Predictions

All Early Predictions Call for a Busy 2024 Atlantic Hurricane Season Forecasters are predicting an exceptionally active Atlantic hurricane season in 2024. The...