A New and Easier Approach to High-Risk Homeowners Insurance. How Can You Find it in 2024? A Video Guide for Those In Need

Navigating High-Risk Homeowners Insurance: The Specialist Approach

Securing homeowners insurance is a routine task for many, but for those with high-risk properties, the process can be significantly more challenging. High-risk homes, which may include those in areas prone to natural disasters, with a history of claims, or with certain structural concerns, often face higher premiums or outright rejections from standard insurance providers. Historically, homeowners have resorted to submitting their information to dozens of agents in hopes of finding coverage. However, this scattershot approach is often ineffective. Instead, the most efficient strategy involves working with a specialist agent who is well-versed in high-risk insurance.

Understanding High-Risk Homeowners Insurance

High-risk homeowners insurance is tailored for properties that standard insurers are reluctant to cover. Factors that may classify a home as high-risk include:

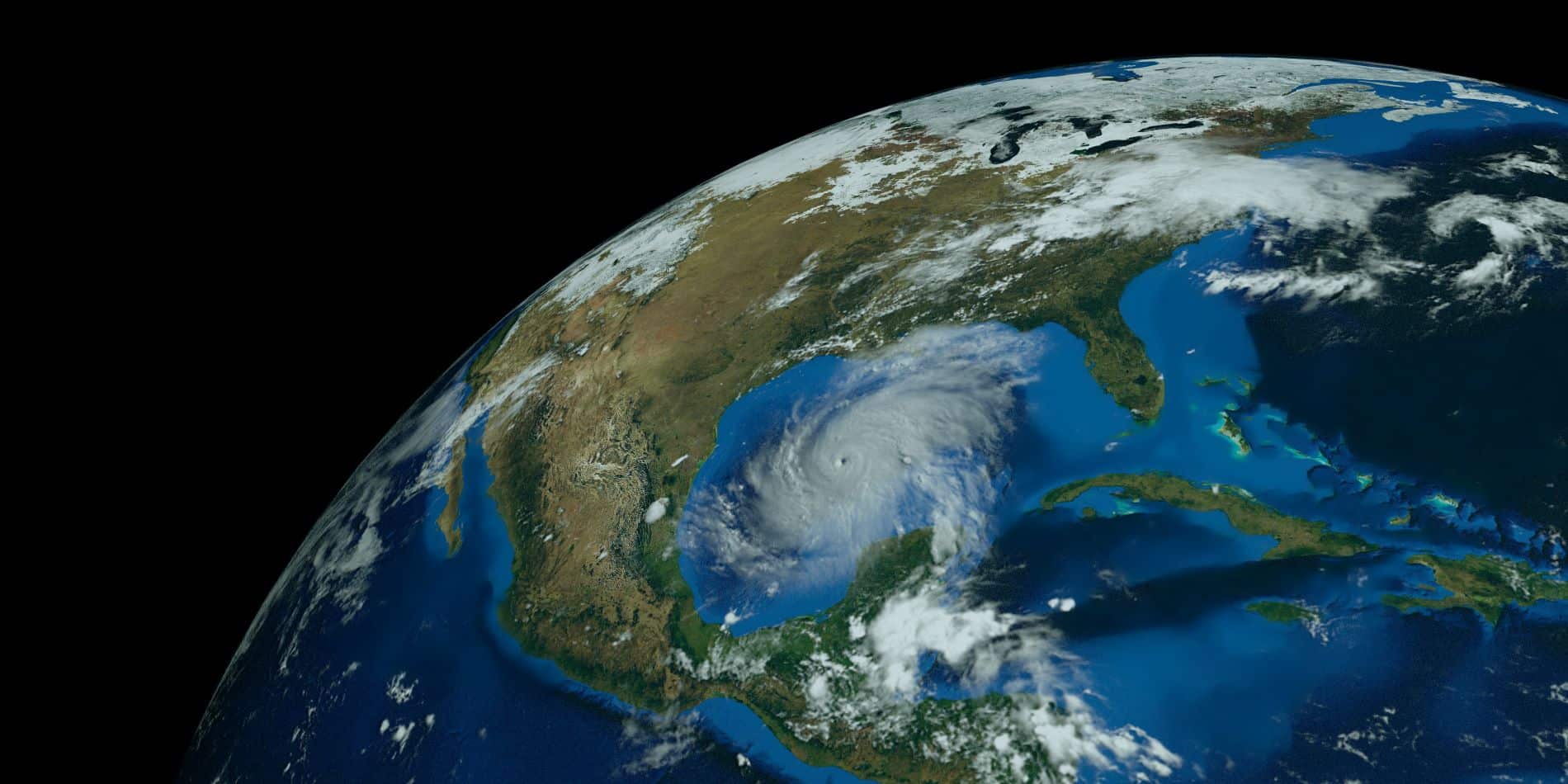

- Location: Homes in areas prone to hurricanes, floods, earthquakes, or wildfires.

- Claims History: Properties with a history of frequent or costly insurance claims.

- Structural Issues: Older homes, homes with outdated electrical systems, or those with unique architectural features.

- Credit History: Homeowners with poor credit scores.

- Lapse in Coverage: A lapse alone can be cause for high-risk homeowners

The Ineffectiveness of the Scattershot Approach

Many homeowners, desperate to secure insurance, adopt a strategy of submitting their details to multiple agents and insurance companies, hoping that at least one will provide a favorable quote. This approach is not only time-consuming but also often leads to frustration for several reasons:

- Inconsistent Information: With multiple submissions, there’s a higher risk of inconsistent information being provided, which can lead to inaccuracies and even rejections.

- Duplicative Efforts: Many agents may work with the same insurers, leading to redundant efforts and no new results.

- Lack of Specialization: General insurance agents might not have the expertise to navigate the complexities of high-risk insurance, resulting in suboptimal coverage options.

The High-Risk Specialist Agent Advantage

The most effective way to secure high-risk homeowners insurance is to work with a specialist agent who understands the intricacies of the market. These agents have the expertise and connections to find the best possible coverage for high-risk properties. Here’s why:

- Expert Knowledge: Specialist agents are familiar with the nuances of high-risk insurance and can navigate the various underwriting challenges involved.

- Access to Niche Markets: They often have relationships with insurers that specifically handle high-risk properties, which are not accessible to general agents.

- Tailored Advice: These agents can provide personalized recommendations and risk mitigation strategies to help reduce premiums and improve insurability.

- Streamlined Process: By working with one knowledgeable agent, homeowners can ensure their information is accurately and consistently presented to potential insurers.

Finding the Right High-Risk Specialist Agent

To find a specialist agent, homeowners should consider the following steps:

- Research: Look for agents or brokers who explicitly state their expertise in high-risk homeowners insurance.

- Ask for Referrals: Speak with other homeowners who have similar properties or consult professionals in the real estate or construction industries.

- Check Credentials: Verify the agent’s credentials, experience, and reviews from previous clients.

- Interview Prospective Agents: Have detailed conversations with potential agents to gauge their understanding of high-risk insurance and their approach to securing coverage. Find an agent that understands the nuances.

Closing the Loop

High-risk homeowners insurance can be daunting to secure, but the key lies in working with a specialist agent who has the knowledge and connections to navigate this complex landscape. Instead of scattering information across multiple agents, potentially complicating the situation further, homeowners should invest in finding one dedicated professional who can provide tailored solutions and streamline the process. This targeted approach not only saves time and effort but also increases the likelihood of securing comprehensive and affordable coverage.

Recent Posts

Claims Surge Amid Unusual 2024 Hurricane Season and What Does it Mean for High Risk Homeowners Insurance?

How is the season so far and what do higher temperatures have to do with it? That warm waters in the tropical Atlantic...

2024- Are Burglary Claims Still a High Risk?

Burglaries are a persistent threat to homeowners across the U.S., with over one million break-ins occurring annually. Even though burglary rates have decreased...

2024 Atlantic Hurricane Season Predictions

All Early Predictions Call for a Busy 2024 Atlantic Hurricane Season Forecasters are predicting an exceptionally active Atlantic hurricane season in 2024. The...