Need Ahwatukee Foothills Village High Risk Homeowners Insurance?

Dropped by Your Insurer or Facing Soaring Premiums? You’re Not Alone

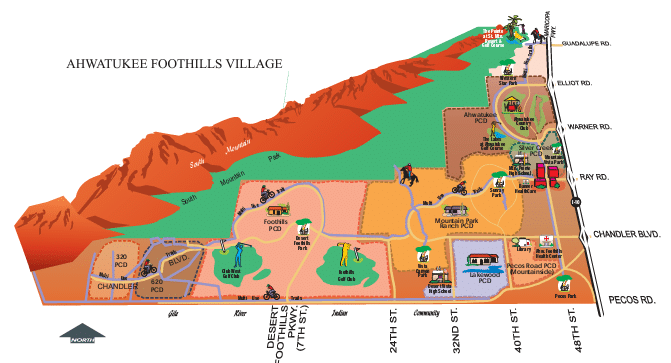

Ahwatukee Foothills Village, tucked between South Mountain Park and the Gila River Indian Community in Phoenix, AZ, is known for its natural beauty and family-friendly neighborhoods. But for many homeowners here, getting reliable insurance coverage is becoming harder than ever.

If you’ve been denied coverage, received a non-renewal notice, or are facing skyrocketing premiums, it’s likely because your property is now considered high risk. That’s where Ahwatukee Foothills High Risk Homeowners Insurance becomes essential in Arizona.

Why Your Home May Be Considered High Risk in Ahwatukee

Even though Ahwatukee offers a quiet suburban lifestyle, it’s not immune to natural disasters and environmental hazards that have led to a sharp rise in insurance claims.

🔥 Wildfires

With its proximity to desert and mountain terrain, Ahwatukee is vulnerable to wildfires—especially during dry summer months. Events like the 2020 Bush Fire heightened regional risk awareness, prompting insurers to reassess coverage in nearby communities.

🌧️ Monsoon Flooding

The 2011 monsoon season brought flash floods that caused extensive property damage across Ahwatukee. Homes near washes or low-lying areas are especially susceptible, and standard homeowners insurance doesn’t cover flood damage.

🌬️ Haboobs and Dust Storms

Severe dust storms like the 2016 haboob have caused widespread property damage, including roof damage, broken windows, and flying debris. These sudden events often result in multiple claims at once—making insurers cautious.

☀️ Extreme Heat & Roof Deterioration

Phoenix’s extreme summer heat isn’t just uncomfortable—it accelerates the deterioration of roofing materials, HVAC units, and siding. Over time, this leads to costly repairs and insurance claims.

⚡ Monsoon Storms & Power Surges

Ahwatukee’s summer storms can bring strong winds, heavy rain, lightning, and power surges that affect electrical systems and damage home interiors.

Environmental & Structural Risks That Affect Insurance

Even without major disasters, everyday environmental factors in Ahwatukee can increase your risk profile:

- Soil movement and foundation cracking from clay soil expansion

- Termite damage due to Arizona’s hot, dry climate

- Aging infrastructure in older homes with outdated systems

- Previous insurance claims related to fire, water, or wind damage

If any of these sound familiar, your property may already be flagged as high risk.

What Is High Risk Homeowners Insurance?

High-risk homeowners insurance is designed for properties that traditional insurers view as too risky to cover affordably—or at all. These policies are structured to address specific threats common to Ahwatukee Foothills homes, including:

- 🔹 Fire and wildfire damage

- 🔹 Flooding and water intrusion

- 🔹 Wind and debris damage from storms

- 🔹 Roof and structural wear caused by extreme heat

While high-risk policies may come with higher premiums or deductibles, they often offer more targeted protection and greater flexibility for homeowners in places like Ahwatukee.

Why You May Have Lost Coverage

Insurers don’t always give detailed reasons when they non-renew a policy—but these are some of the most common in Ahwatukee:

- You filed multiple claims in the past 5–10 years

- Your roof, HVAC, or plumbing systems are outdated

- Your home is in or near a flood-prone or wildfire-risk area

- Your insurer is exiting or scaling back in Arizona’s higher-risk ZIP codes

If this happened to you, know that there are still reliable insurance alternatives out there.

What to Look for in Ahwatukee Foothills High Risk Homeowners Insurance

Not all high-risk policies are created equal. Make sure your coverage includes:

✅ Wildfire protection tailored to desert-adjacent homes

✅ Flood insurance, even if you’re not in a FEMA-designated zone

✅ Windstorm and dust damage coverage

✅ Extended replacement cost to rebuild at today’s prices

✅ Personal property and liability protection

A policy that lacks any of the above could leave you exposed when the next storm or fire hits.

Protecting Your Home Doesn’t Have to Be Overwhelming

Living in a high-risk area doesn’t mean you’re uninsurable. It just means you need the right policy—and the right partner—to protect what matters most. Ahwatukee Foothills High-Risk Homeowners Insurance gives you:

- 🔹 Options when standard carriers say no

- 🔹 Coverage based on real risks—not assumptions

- 🔹 Support from people who understand Arizona weather and housing

You’ve worked hard for your home. Don’t let insurance complications put it at risk.

Explore Your High-Risk Coverage Options Today

Whether you’ve already lost coverage or want to avoid a surprise non-renewal, it’s time to take action. We’ll help you compare Ahwatukee Foothills High Risk Homeowners Insurance alternatives that give you the protection you need—without the guesswork.

📝 No pressure. No spam. Just straightforward answers and custom-fit coverage.

FAQ about Ahwatukee Foothills High Risk Homeowners Insurance

What are the most common natural disasters in Ahwatukee Foothills Village?

Ahwatukee is prone to wildfires, flooding during the monsoon season, and haboobs (intense dust storms). These natural disasters can cause significant damage to homes and properties.

How can extreme heat affect my home insurance in Ahwatukee?

Extreme heat can lead to increased wear and tear on roofs and air conditioning units. This can result in higher maintenance costs and insurance claims for damage caused by prolonged exposure to high temperatures.

What should I know about monsoon storms and their impact on homeowners insurance?

Monsoon storms bring heavy rains, strong winds, and lightning. These storms can cause flooding, wind damage, and power surges, leading to substantial insurance claims. Ensuring your home is prepared for these events is crucial.

How does soil subsidence affect homeowners in Ahwatukee?

The clay soils in the region can expand and contract with moisture changes, causing foundation issues. Soil subsidence can lead to cracks in walls and foundations, resulting in costly repairs and insurance claims.

What are the risks of pest infestations in Ahwatukee?

The warm climate in Ahwatukee is ideal for pests like termites, which can cause significant structural damage to homes. Homeowners often need to invest in pest control measures and may face insurance claims for damage caused by infestations.

How can I protect my home from wildfire risks in Ahwatukee?

Implement fire-proofing measures such as clearing vegetation around your home, using fire-resistant building materials, and having an emergency preparedness plan. These steps can reduce the risk of wildfire damage and potentially lower your insurance premiums.

What specific events in the past have led to a high volume of insurance claims in Ahwatukee?

Notable events include the 1995 superstorm, 2011 monsoon flooding, 2013 Yarnell Hill Fire, 2016 haboob, and the 2020 Bush Fire. These events highlighted the importance of adequate insurance coverage and preparedness for natural disasters.

How can I ensure my homeowners insurance policy adequately covers these risks?

Review your insurance policy regularly and consult with your insurance agent to ensure it covers natural disasters, weather-related damages, and environmental risks specific to Ahwatukee. Consider additional coverage options if necessary.

What steps can I take to mitigate these risks and potentially lower my insurance premiums?

Implement preventive measures such as fire-proofing your home, maintaining your property to withstand extreme heat, preparing for monsoon storms, and addressing pest infestations promptly. These actions can help reduce risks and may lead to lower insurance premiums.

By understanding the risks and taking proactive steps to mitigate them, homeowners in Ahwatukee Foothills Village can better protect their properties and ensure they have the necessary insurance coverage to handle potential losses.

Request A Quote Now!

"*" indicates required fields