"*" indicates required fields

Nestled on the East Coast of the United States, Virginia’s rich historical tapestry and diverse geography present a unique blend of natural beauty and historical significance. From the Atlantic Ocean coastline to the Appalachian Mountains, the Commonwealth of Virginia is not just a hub of American history but also a land of varied natural landscapes. However, this diversity brings with it a spectrum of risks that homeowners should be acutely aware of, especially when it comes to insurance and some of the aspects of the state that create a high risk for claims.

Geographical and Historical Context

Virginia, one of the original 13 colonies, is bordered by Maryland, Washington D.C., North Carolina, Tennessee, Kentucky, and West Virginia. Its history, marked by pivotal events like the American Revolution and the Civil War, is as varied as its landscape. This variety contributes to a range of natural risks for homeowners, from coastal storms to mountainous snowfalls.

Types of Risks and Historical Events

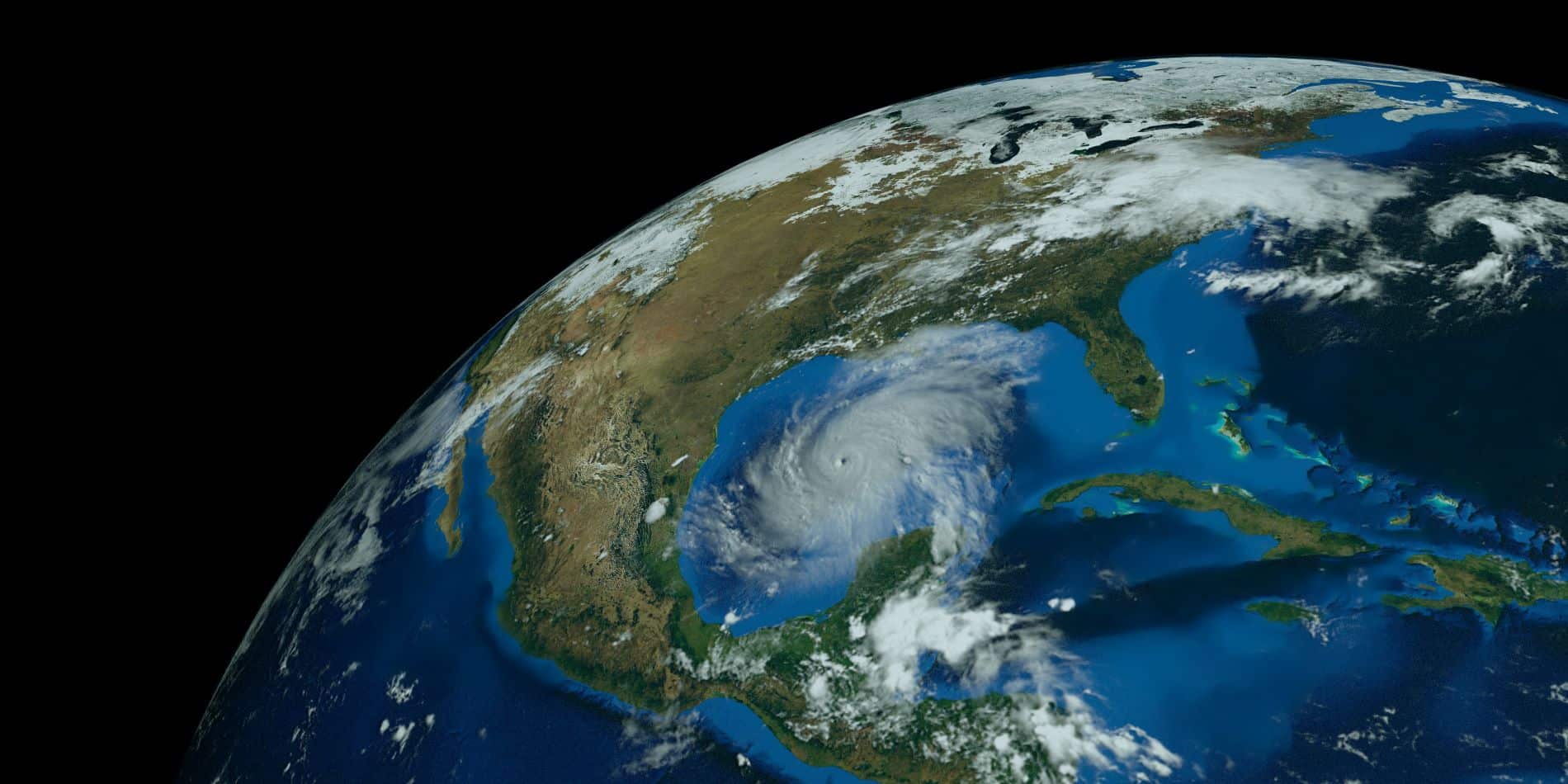

- Hurricanes and Coastal Storms:

- Example: Hurricane Isabel in 2003 remains one of the most significant hurricanes to impact Virginia, causing extensive destruction in coastal areas due to high winds and storm surges. It exemplifies the severe damage Atlantic hurricanes can inflict on homes in Virginia.

- Floods:

- Context: Low-lying and coastal areas in Virginia are particularly prone to flooding, exacerbated by hurricanes and heavy rains.

- Insurance Implication: Flood damage often requires separate flood insurance, as standard homeowner policies do not cover it.

- Tornadoes:

- Historical Reference: The April 2011 tornado outbreak was a stark reminder of the tornado risk in Virginia, leading to substantial property damage and insurance claims.

- Earthquakes:

- Example: The 2011 earthquake near Mineral, VA, was a rare but significant event that caused considerable damage, particularly in Central Virginia. It underscored the need for earthquake coverage, which is typically not included in standard policies.

- Winter Storms:

- Historical Events: The Blizzard of 1996 and the 2009-2010 North American blizzards were significant winter events leading to heavy insurance claims due to roof collapses and other property damages caused by snow and ice.

Insurance Considerations for Virginia Homeowners

Given the range of natural disasters in Virginia, it is crucial for homeowners to understand their insurance policies thoroughly. Standard homeowner policies in Virginia typically cover damages from tornadoes and winter storms. However, for risks like floods and earthquakes, additional coverage is necessary.

Preventive Measures and Risk Mitigation

Homeowners can also take proactive steps to mitigate these risks:

- Hurricane Preparedness: Reinforcing roofs, installing storm shutters, and ensuring proper drainage can minimize hurricane damage.

- Flood Mitigation: Elevating homes and installing sump pumps can reduce flood risk.

- Winterizing Homes: Insulating pipes and ensuring proper roof maintenance can prevent winter damage.

Living in Virginia brings the responsibility of understanding and preparing for a variety of natural risks. Homeowners should evaluate their insurance coverage in light of Virginia’s diverse climate and historical events to ensure adequate protection against potential losses. Staying informed and prepared is key to safeguarding your home against the unforeseen yet inevitable forces of nature in this historically rich and geographically diverse state.

Recent Posts

2024- Are Burglary Claims Still a High Risk?

Burglaries are a persistent threat to homeowners across the U.S., with over one million break-ins occurring annually. Even though burglary rates have decreased...

2024 Atlantic Hurricane Season Predictions

All Early Predictions Call for a Busy 2024 Atlantic Hurricane Season Forecasters are predicting an exceptionally active Atlantic hurricane season in 2024. The...

Top High-Risk Home Insurance Factors

When you own a home, one of the most important things you need is home insurance. This insurance helps protect your house and...