"*" indicates required fields

Nestled in the heartland of Northwest Tennessee, the city of Dyersburg serves as a charming testament to the region’s rich agricultural heritage and industrious spirit. As the county seat of Dyer County, Dyersburg boasts a significant historical presence, primarily known for its pivotal role in the cotton industry. However, the geographical positioning of Dyersburg, near the mighty Mississippi River, brings with it not just the bounties of nature but also certain risks that homeowners should be acutely aware of.

For residents of Dyersburg, understanding the nuances of homeowners insurance is not just a matter of regulatory compliance but a critical necessity. The city’s proximity to various natural phenomena makes it susceptible to a range of risks that can potentially lead to substantial home insurance losses.

1. The Perils of Water: Flooding in Dyersburg

One of the most prominent risks that loom over homeowners in Dyersburg is flooding. The proximity of the city to the Mississippi River predisposes it to the whims of this water giant, especially during periods of excessive rainfall and severe weather events. The floods of 2010 are a stark reminder of the devastating impact of unbridled waters. These severe storms transformed streets into rivers and homes into isolated islands, inflicting extensive damage to properties and leading to a surge in insurance claims. Homeowners are advised to consider flood insurance seriously, as standard home insurance policies typically do not cover flood damage.

2. The Fury of the Skies: Severe Weather and Tornadoes

Dyersburg’s location also makes it a hotspot for severe weather events, including tornadoes and thunderstorms. The city has witnessed several such events over the years, with significant occurrences in the 1990s and 2000s. The ferocity of these natural events is not to be underestimated, as they can swiftly turn buildings and homes into piles of rubble. Sitting north of Memphis TN, Dyersburg seems to take an extraordinarily high brunt of the severe weather entering across the Mississippi River. Given the frequency and intensity of these weather phenomena, residents are urged to ensure their home insurance policies encompass coverage for such eventualities.

3. The Trembling Ground: Earthquake Risks

While not as frequent, the risk of earthquakes in Dyersburg is a reality that homeowners must confront. Positioned within the New Madrid Seismic Zone, the city is not immune to the tremors of the earth. These seismic events, though rare, can result in catastrophic damage to properties, underlining the importance of considering earthquake coverage in home insurance policies. Consumers also need to understand how percentage deductibles work especially due to the high risk of earthquake claims.

4. The Cold Embrace: Ice Storms

Not to be overlooked are the winter perils, particularly ice storms, which can wreak havoc on properties. The weight of ice can lead to structural damage, including roof collapses and fallen trees, causing homeowners to face unexpected repair costs and insurance claims.

In conclusion, the residents of Dyersburg live in a city that is not only rich in history and culture but also exposed to a variety of natural risks. From the flooding brought on by the nearby Mississippi River to the unpredictable severity of tornadoes and storms, and the potential tremors of earthquakes, homeowners must navigate these challenges with prudence as well as insurance companies to remain profitable and not be forced out of the market. Ensuring that home insurance policies comprehensively cover these risks is not just prudent but essential. As the city continues to thrive and grow, understanding and preparing for these risks will ensure that the heritage and future of Dyersburg remain secure and resilient.

Recent Posts

2024- Are Burglary Claims Still a High Risk?

Burglaries are a persistent threat to homeowners across the U.S., with over one million break-ins occurring annually. Even though burglary rates have decreased...

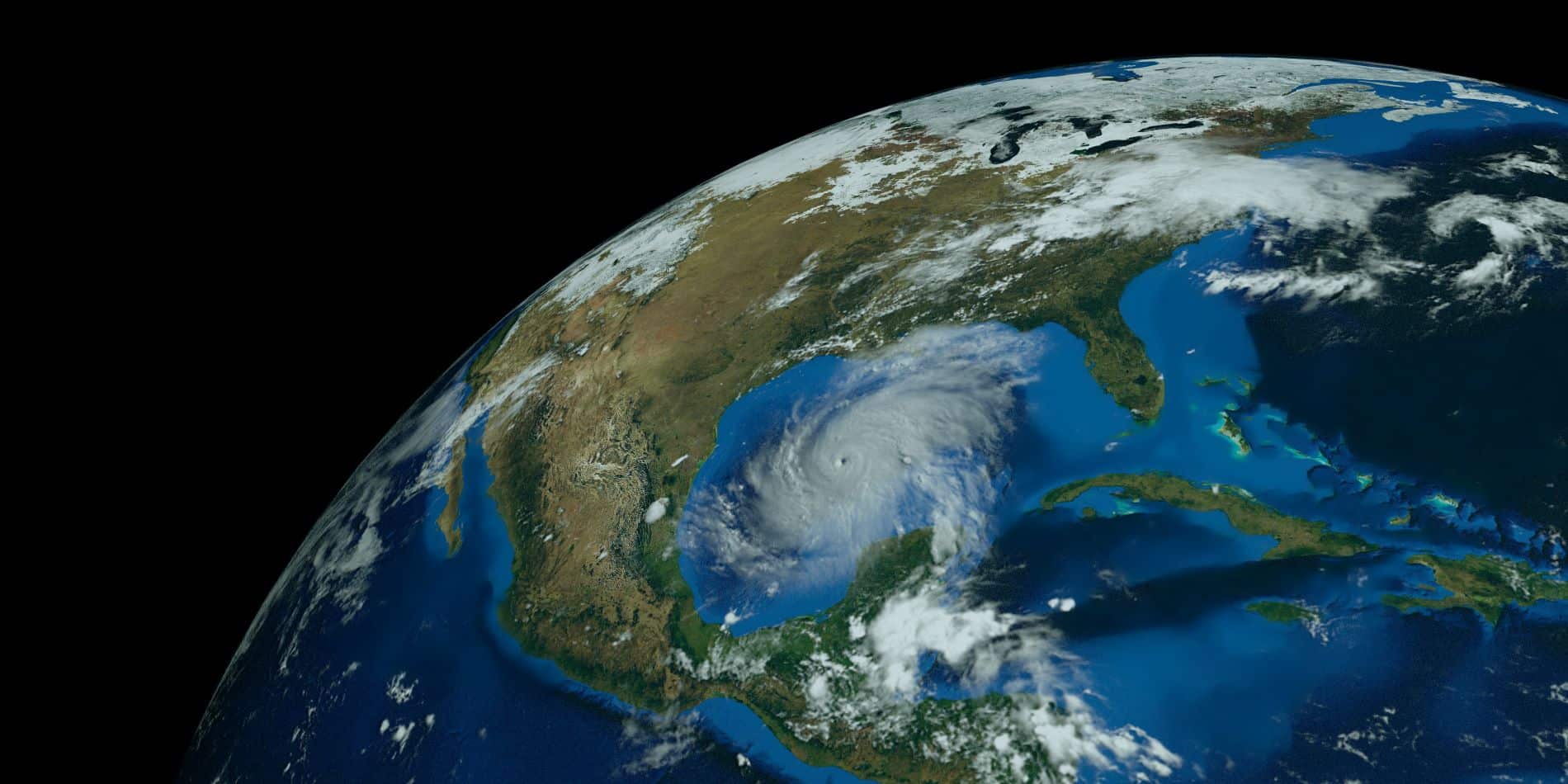

2024 Atlantic Hurricane Season Predictions

All Early Predictions Call for a Busy 2024 Atlantic Hurricane Season Forecasters are predicting an exceptionally active Atlantic hurricane season in 2024. The...

Top High-Risk Home Insurance Factors

When you own a home, one of the most important things you need is home insurance. This insurance helps protect your house and...