"*" indicates required fields

Milton’s Insurance Story

Homeownership in Milton, Georgia, comes with its unique set of challenges, especially when it comes to understanding and preparing for risks that could lead to insurance claims. The picturesque city, while offering a serene lifestyle, is not immune to the whims of nature and other hazards. It is important for an experienced high risk homeowners agent to guide homeowners in Milton through the various risks that could impact their homes and the importance of adequate insurance coverage.

Understanding the Risks:

- Severe Weather Threats: Milton, like much of Georgia, is prone to severe weather events. Tornadoes, though less high risk than in the Midwest, still pose a significant threat, capable of causing devastating damage to properties. Thunderstorms, often accompanied by strong winds, hail, and lightning, are more common and can lead to a range of damages, from roof and siding impairments to more severe structural issues.

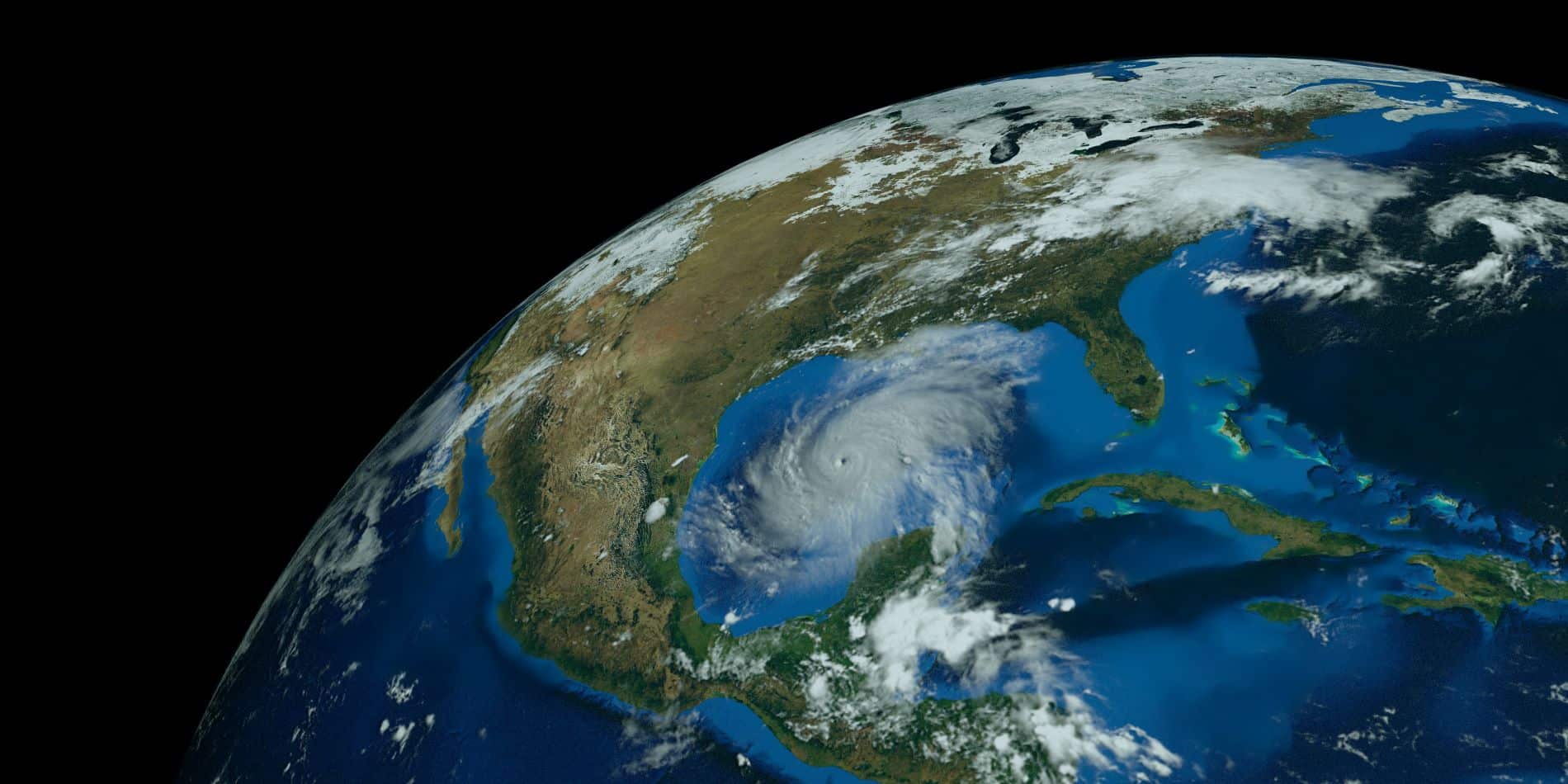

- The Impact of Hurricanes and Tropical Storms: While Milton is relatively inland, the remnants of hurricanes and tropical storms can reach the area, bringing with them heavy rains and strong winds. These conditions can lead to flooding, a risk not typically covered under standard home insurance policies, and wind damage, underscoring the importance of reviewing insurance policies for specific coverage details.

- Fire Risks: Residential fires, whether sparked by natural causes like lightning or due to human-related incidents such as electrical faults, are a constant risk. These fires can result in substantial damage, making it crucial for homeowners to ensure their insurance coverage encompasses fire damage.

- Winter Weather Woes: Although less frequent, winter weather, including ice storms and heavy snowfall, can cause significant damage in Milton. Issues such as frozen pipes, roof damage from the weight of snow, and fallen tree limbs are potential risks during colder months.

Historical Events and Their Impact:

Milton has witnessed several significant weather-related events that have led to extensive home insurance claims. Notable among these are:

- Tornado Outbreaks: These have periodically affected the region, causing widespread

- to homes and infrastructure. Tornadoes can rip roofs off houses, shatter windows, and even lead to complete property loss, emphasizing the need for robust insurance coverage against such events.

- Hurricane Remnants: While Milton does not face direct hurricane hits, the remnants of these massive storms have historically brought damaging winds and floods. For instance, the aftereffects of hurricanes passing through the state have resulted in significant claims due to roof damage, fallen trees, and water intrusion.

- Ice Storms: On rare occasions, severe winter weather, including ice storms, has struck Milton. These events can lead to a cascade of problems, such as burst pipes, roof collapses under the weight of ice and snow, and damage from falling branches. These incidents highlight the importance of insurance that covers a range of winter-related damages.

- Flooding Events: Specific instances of flooding, particularly following tropical storms or prolonged heavy rainfall, have led to considerable insurance claims. Flooding can cause foundational damage, mold growth, and ruin personal property, making it crucial for homeowners to consider additional flood insurance, especially in susceptible areas.

- Preparation and Insurance Considerations:

- Understanding these risks is the first step in preparing for them. Homeowners in Milton should:

- Review Insurance Policies: Ensure that your home insurance policy covers the types of risks most prevalent in Milton. Standard policies may not cover flood damage, so additional flood insurance might be necessary.

- Mitigate Risks: Take proactive measures to protect your home. This can include installing storm shutters, reinforcing roofs, and ensuring proper drainage around the property.

- Stay Informed: Keep abreast of local weather forecasts and heed warnings from local authorities. Having a plan for severe weather events can significantly reduce the risk to your home and family.

- Document and Inventory: Keep an up-to-date inventory of your possessions and document your home’s condition. This practice can be invaluable in the event of an insurance claim.

Living in Milton, Georgia, means enjoying its beauty and tranquility, but it also requires being prepared for the various risks that come with it. By understanding these risks, reviewing and updating insurance coverage, and taking proactive steps to protect your property, you can ensure that your haven in Milton remains safe and secure, no matter what nature throws your way.

Recent Posts

2024- Are Burglary Claims Still a High Risk?

Burglaries are a persistent threat to homeowners across the U.S., with over one million break-ins occurring annually. Even though burglary rates have decreased...

2024 Atlantic Hurricane Season Predictions

All Early Predictions Call for a Busy 2024 Atlantic Hurricane Season Forecasters are predicting an exceptionally active Atlantic hurricane season in 2024. The...

Top High-Risk Home Insurance Factors

When you own a home, one of the most important things you need is home insurance. This insurance helps protect your house and...