"*" indicates required fields

Understanding Homeowners Insurance Risks in Ahwatukee Foothills Village, AZ

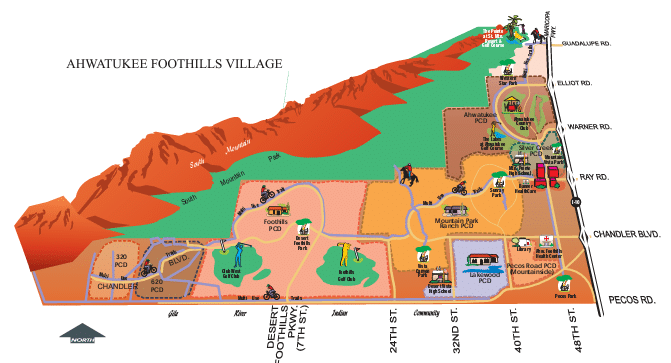

Ahwatukee Foothills Village, a picturesque suburban neighborhood in the southernmost part of Phoenix, Arizona, is celebrated for its scenic beauty and vibrant community life. Nestled between South Mountain Park and the Gila River Indian Community, Ahwatukee offers a unique blend of natural beauty and suburban convenience. However, like any other region, it is not without its risks, particularly when it comes to homeowners insurance. Understanding these risks is crucial for residents to ensure their properties are adequately protected.

Natural Disasters

Wildfires: The proximity of Ahwatukee to desert and mountainous areas makes it vulnerable to wildfires, especially during the dry summer months. Wildfires can spread rapidly, fueled by dry vegetation and high winds, posing a significant threat to homes and properties. The 2020 Bush Fire, one of the largest wildfires in Arizona’s history, although not directly impacting Ahwatukee, heightened awareness of wildfire risks across the region. This event led many homeowners to file insurance claims for fire-proofing measures and emergency preparedness upgrades.

Flooding: While not a common occurrence, flooding can happen during the monsoon season, which typically runs from June to September. The 2011 monsoon season, for instance, brought unprecedented rainfall to Ahwatukee, causing flash floods that led to numerous home insurance claims for water damage, mold remediation, and property repairs. Homes near washes and low-lying areas are particularly susceptible to flooding during heavy rains.

Haboobs: Haboobs, or intense dust storms, are another natural disaster that can cause significant damage in Ahwatukee. These storms, characterized by high winds and reduced visibility, can lead to accidents and property damage. In 2016, a massive haboob swept through the Phoenix metropolitan area, including Ahwatukee, causing damage from high winds and debris. This event resulted in many homeowners filing claims for repairs due to wind damage and debris impact.

Weather-Related Risks

Extreme Heat: The intense summer heat in Phoenix is a well-known challenge for residents. Prolonged exposure to extreme temperatures can lead to increased wear and tear on homes, particularly on roofs and air conditioning units. Homeowners often face higher maintenance costs and insurance claims for damage caused by the relentless heat.

Monsoon Storms: Monsoon storms bring heavy rains, strong winds, and lightning, which can cause a variety of damages. These storms can lead to flooding, wind damage, and power surges, all of which can result in substantial insurance claims. The 1995 superstorm is a notable example, where heavy rain, high winds, and widespread flooding led to numerous home insurance claims for water damage and wind-related incidents.

Environmental Risks

Soil Subsidence: The region’s clay soils can expand and contract with moisture changes, potentially leading to foundation issues. Soil subsidence can cause cracks in walls and foundations, resulting in costly repairs and insurance claims.

Pest Infestations: The warm climate of Ahwatukee is ideal for pests like termites, which can cause significant structural damage to homes. Homeowners often need to invest in pest control measures and may face insurance claims for damage caused by infestations.

Historical Events Leading to High Volume Insurance Claims

1995 Superstorm: This severe storm brought heavy rain, high winds, and widespread flooding to Ahwatukee, leading to numerous insurance claims for water damage and wind-related incidents. The storm highlighted the importance of adequate coverage for weather-related risks.

2011 Monsoon Flooding: The unprecedented rainfall during the 2011 monsoon season caused flash floods that resulted in significant home insurance claims for water intrusion, mold remediation, and property repairs.

2013 Yarnell Hill Fire: Although primarily impacting areas north of Phoenix, the increased risk and awareness of wildfires led to heightened insurance claims for fire prevention measures and related home improvements in Ahwatukee.

2016 Dust Storm (Haboob): The massive haboob in 2016 caused visibility issues and damage to homes from high winds and debris, resulting in a surge of insurance claims for wind damage and debris impact.

2020 Bush Fire: While this fire did not directly impact Ahwatukee, the increased risk awareness led to numerous insurance claims for fire-proofing measures and emergency preparedness upgrades.

Conclusion

Residents of Ahwatukee Foothills Village must remain vigilant about the various risks associated with their homes. Understanding the potential for natural disasters, weather-related damages, and environmental risks can help homeowners take preventive measures and ensure they have adequate insurance coverage. By learning from past events and staying prepared, Ahwatukee residents can protect their homes and reduce the likelihood of significant insurance losses in the future.

FAQ about High-Risk Homeowners Insurance in Southern Phoenix

1. What are the most common natural disasters in Ahwatukee Foothills Village?

- Ahwatukee is prone to wildfires, flooding during the monsoon season, and haboobs (intense dust storms). These natural disasters can cause significant damage to homes and properties.

2. How can extreme heat affect my home insurance in Ahwatukee?

- Extreme heat can lead to increased wear and tear on roofs and air conditioning units. This can result in higher maintenance costs and insurance claims for damage caused by prolonged exposure to high temperatures.

3. What should I know about monsoon storms and their impact on homeowners insurance?

- Monsoon storms bring heavy rains, strong winds, and lightning. These storms can cause flooding, wind damage, and power surges, leading to substantial insurance claims. Ensuring your home is prepared for these events is crucial.

4. How does soil subsidence affect homeowners in Ahwatukee?

- The clay soils in the region can expand and contract with moisture changes, causing foundation issues. Soil subsidence can lead to cracks in walls and foundations, resulting in costly repairs and insurance claims.

5. What are the risks of pest infestations in Ahwatukee?

- The warm climate in Ahwatukee is ideal for pests like termites, which can cause significant structural damage to homes. Homeowners often need to invest in pest control measures and may face insurance claims for damage caused by infestations.

6. How can I protect my home from wildfire risks in Ahwatukee?

- Implement fire-proofing measures such as clearing vegetation around your home, using fire-resistant building materials, and having an emergency preparedness plan. These steps can reduce the risk of wildfire damage and potentially lower your insurance premiums.

7. What specific events in the past have led to a high volume of insurance claims in Ahwatukee?

- Notable events include the 1995 superstorm, 2011 monsoon flooding, 2013 Yarnell Hill Fire, 2016 haboob, and the 2020 Bush Fire. These events highlighted the importance of adequate insurance coverage and preparedness for natural disasters.

8. How can I ensure my homeowners insurance policy adequately covers these risks?

- Review your insurance policy regularly and consult with your insurance agent to ensure it covers natural disasters, weather-related damages, and environmental risks specific to Ahwatukee. Consider additional coverage options if necessary.

9. What steps can I take to mitigate these risks and potentially lower my insurance premiums?

- Implement preventive measures such as fire-proofing your home, maintaining your property to withstand extreme heat, preparing for monsoon storms, and addressing pest infestations promptly. These actions can help reduce risks and may lead to lower insurance premiums.

By understanding the risks and taking proactive steps to mitigate them, homeowners in Ahwatukee Foothills Village can better protect their properties and ensure they have the necessary insurance coverage to handle potential losses.

Recent Posts

2024- Are Burglary Claims Still a High Risk?

Burglaries are a persistent threat to homeowners across the U.S., with over one million break-ins occurring annually. Even though burglary rates have decreased...

2024 Atlantic Hurricane Season Predictions

All Early Predictions Call for a Busy 2024 Atlantic Hurricane Season Forecasters are predicting an exceptionally active Atlantic hurricane season in 2024. The...

Top High-Risk Home Insurance Factors

When you own a home, one of the most important things you need is home insurance. This insurance helps protect your house and...