"*" indicates required fields

Alabama, a state steeped in history and marked by a diverse landscape, is also a region where homeowners must be particularly vigilant about insurance risks. Nestled in the southeastern corner of the United States, bordered by Tennessee, Georgia, Florida, the Gulf of Mexico, and Mississippi, Alabama has a unique geographical and climatic profile that makes it prone to various natural disasters. This article aims to educate homeowners about the significant risks in Alabama and the importance of suitable insurance coverage, backed by historical examples.

Tornadoes: A Frequent Menace

Central and Northern Alabama, part of the infamous “Dixie Alley,” are notorious for frequent and severe tornado activity. The state’s history is scarred by devastating tornadoes, with the April 2011 Tornado Outbreak being a grim reminder. This catastrophic event involved multiple tornadoes sweeping across the state, leaving a trail of destruction in their wake. Homes were obliterated, highlighting the necessity for insurance policies that specifically cover tornado damage. The 1998 Oak Grove Tornado, which ravaged the Birmingham area, further underscores this need.

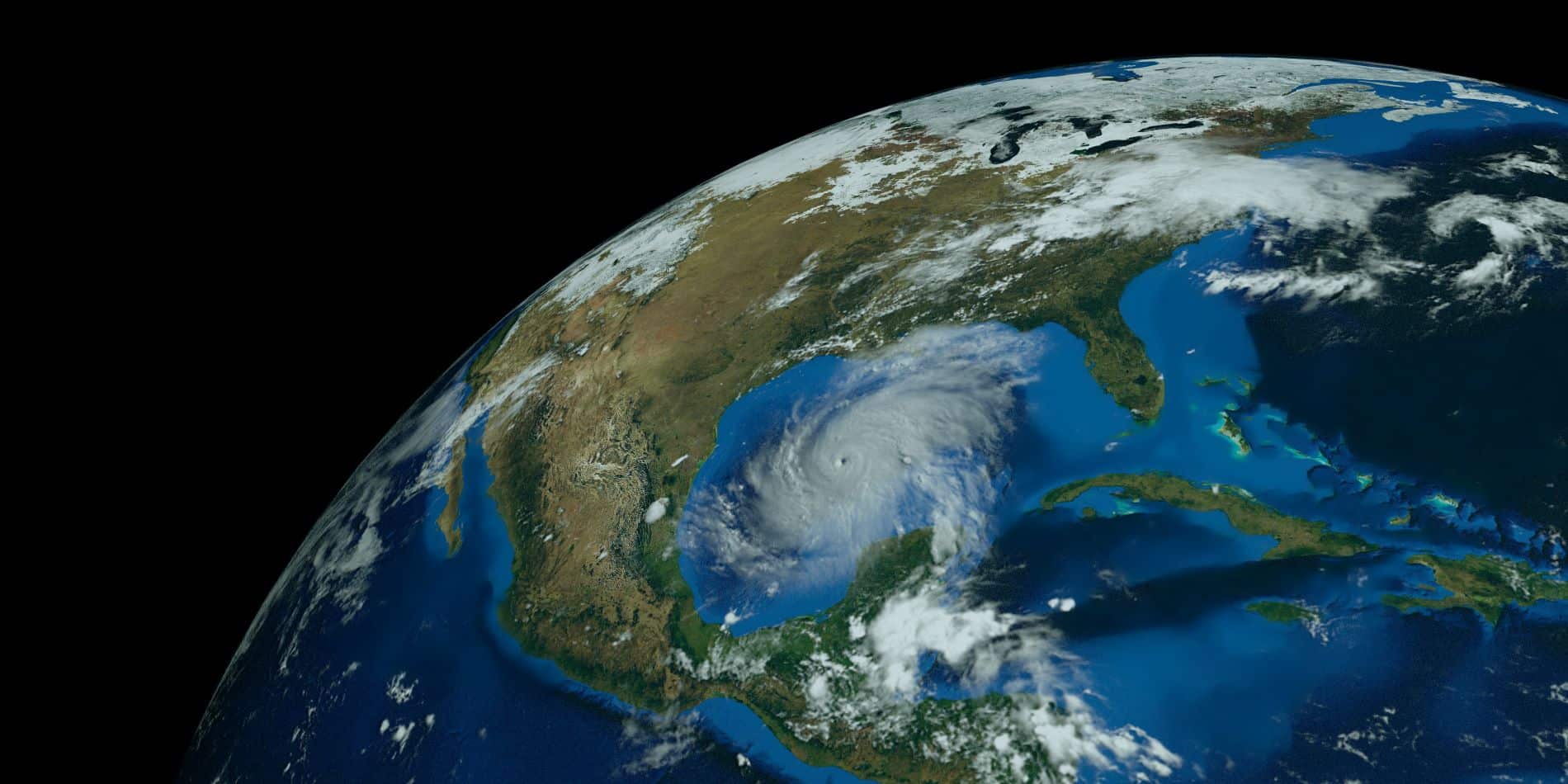

Hurricanes and Tropical Storms: The Coastal Threat

Alabama’s Gulf Coast is no stranger to the ravages of hurricanes and tropical storms. The powerful Hurricane Ivan in 2004 illustrated the extensive damage these storms can cause, including wind damage, flooding, and storm surges. Homeowners in coastal and low-lying areas need to ensure their insurance policies cover such events, as standard policies may not always provide adequate protection against flood damage.

Flooding: A Persistent Risk

Apart from hurricanes, Alabama faces a constant threat of flooding, particularly in its low-lying and coastal regions. Flooding can result from various causes, including heavy rains and storm surges. While some might overlook this risk, it’s crucial for homeowners to understand that standard home insurance policies do not typically cover flood damage. Thus, purchasing additional flood insurance is advisable, especially in high-risk areas.

Wind Damage and Hail: The Silent Destroyers

High winds and hail storms, though less dramatic than tornadoes or hurricanes, can cause significant damage to properties. Roofs, windows, and structures are particularly vulnerable. Events in 2016 and 2017, which saw severe weather causing substantial property damage, are stark reminders of these risks. Homeowners should ensure their policies cover such damages, which are frequent but often overlooked.

Homeownership in Alabama comes with its unique set of challenges. The state’s diverse weather patterns and geographical location make it susceptible to a variety of natural disasters. Homeowners must be proactive in understanding and preparing for these risks. Adequate insurance coverage is not just a safety net but a necessity in this region. By learning from historical events and tailoring insurance policies to address these specific risks, Alabama homeowners can safeguard their homes and families against the unpredictable forces of nature. In a state where history has shown the power of natural events, being prepared is not just prudent; it’s essential.

Recent Posts

Claims Surge Amid Unusual 2024 Hurricane Season and What Does it Mean for High Risk Homeowners Insurance?

How is the season so far and what do higher temperatures have to do with it? That warm waters in the tropical Atlantic...

2024- Are Burglary Claims Still a High Risk?

Burglaries are a persistent threat to homeowners across the U.S., with over one million break-ins occurring annually. Even though burglary rates have decreased...

2024 Atlantic Hurricane Season Predictions

All Early Predictions Call for a Busy 2024 Atlantic Hurricane Season Forecasters are predicting an exceptionally active Atlantic hurricane season in 2024. The...