Understanding Home Insurance Rates

Home insurance rates can sometimes feel like a mystery, but understanding how they are determined and what you can do to manage them is crucial. These rates are influenced by various factors, including the location of your home, its age, and your personal claims history. By knowing these details, you can make informed decisions to potentially lower your insurance costs. Additionally, improving your home’s safety features and shopping around for the best quotes can also make a significant difference in your overall expenses.

Factors Affecting Home Insurance Rates

Several key factors play a role in determining your insurance rates. The location of your home is a major consideration, as areas prone to natural disasters or with higher crime rates typically have higher insurance costs. The age and condition of your home also matter; older homes might require more maintenance, leading to higher premiums. Additionally, your personal insurance history, including previous claims, can impact your rates, as insurers assess the likelihood of future claims.

Do home insurance rates go up over time?

Home insurance rates can go up over time for several reasons. Inflation, increased costs of building materials and labor, and changes in your area’s risk factors can all contribute to higher premiums. Even if you haven’t made any claims, your rate might increase due to these external factors.

Home Insurance Rates FAQs

What are home insurance rates?

Home insurance rates are the amount of money you pay for your home insurance policy. This rate can vary based on many factors including the size of your home, location, and the type of coverage you choose.

How are home insurance rates determined?

Insurance companies determine insurance rates using several factors. These include the value of your home and its contents, the location of your home, your claims history, and the level of coverage you select. Each company uses its own formula to calculate rates, so they can vary widely.

Can I lower the insurance rate for my home?

Yes, there are several ways to lower your home insurance rate. Increasing your deductible, improving your home’s security, and maintaining a good claims history can all help reduce your premium. Additionally, shopping around and comparing quotes from different insurers can lead to better rates.

Does the age of my home affect my insurance rate?

Yes, the age of your home can affect your insurance rate. Older homes may have outdated systems and structures that are more likely to need repairs, making them riskier to insure. As a result, they often have higher insurance rates.

What is a deductible in home insurance?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. For example, if you have a $1,000 deductible and a claim for $5,000 in damages, you would pay $1,000 and your insurance would cover the remaining $4,000. Higher deductibles usually mean lower insurance premiums.

How often should I review my home insurance policy?

It’s a good idea to review your home insurance policy annually or whenever you make significant changes to your home. This ensures that your coverage is up to date and that you are not overpaying for your insurance.

What should I consider when choosing a home insurance policy?

When choosing a home insurance policy, consider the coverage options, deductibles, premiums, and the reputation of the insurance company. Make sure the policy covers all potential risks relevant to your home and that you understand the terms and conditions.

Is it possible to get discounts on home insurance?

Yes, many insurance companies offer discounts on home insurance. You might get discounts for having security systems, smoke detectors, or a claims-free history. Some companies also offer discounts if you bundle your home insurance with other policies, like auto insurance.

Can my credit score affect my home insurance rate?

Yes, your credit score can affect your home insurance rate. Insurers often use credit scores to help determine risk. Generally, a higher credit score can lead to lower insurance premiums because insurers view you as less likely to file claims.

What happens if I miss a payment on my home insurance?

If you miss a payment on your home insurance, your coverage could be at risk. Most insurers offer a grace period, but if you fail to pay within that time, your policy may be canceled. This could leave you without coverage and make it harder to get insurance in the future.

What is included in a standard home insurance policy?

A standard home insurance policy typically includes coverage for the structure of your home, your personal belongings, liability protection, and additional living expenses if your home is uninhabitable due to a covered loss. It’s important to read your policy to understand what is and isn’t covered.

Can I change my home insurance policy at any time?

Yes, you can usually change your home insurance policy at any time. However, it’s best to do this at the end of your policy term to avoid penalties or fees. Always compare new policies carefully to ensure they meet your needs and offer better rates or coverage.

Why do insurance rates vary by location?

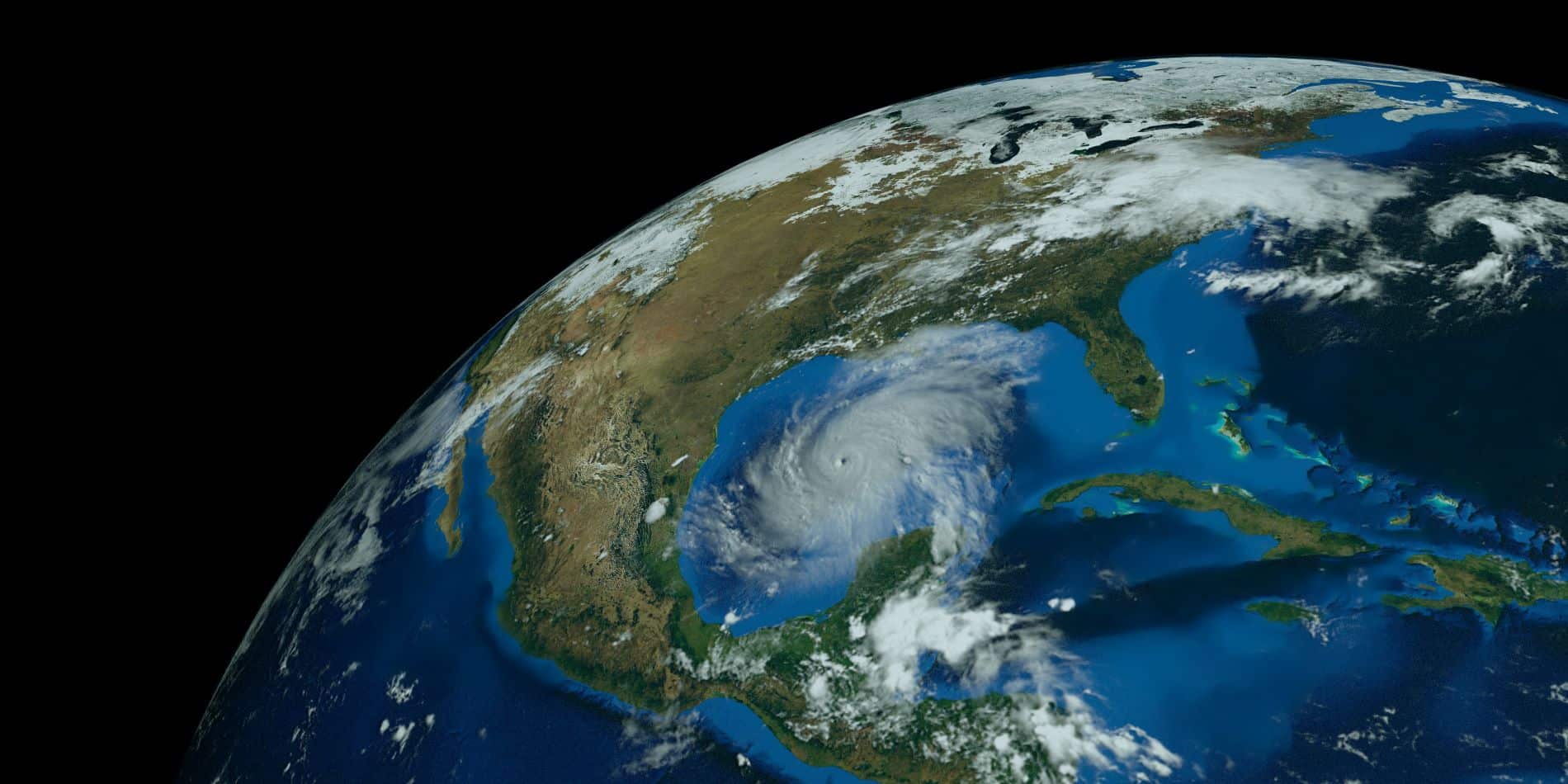

Home insurance rates vary by location because different areas have different levels of risk. For example, homes in areas prone to natural disasters like floods, hurricanes, or earthquakes generally have higher rates. Crime rates in your area can also affect your insurance costs.

Highest Average Cost Of Home Insurance

Home insurance rates vary significantly across the United States, with some states seeing much higher premiums than others due to various factors like severe weather events. Here are the states with the highest insurance rates in 2024:

Here are the top 20 states with the highest home insurance rates in 2024, along with the full source URLs:

- Florida: $11,759 per year

- Florida faces the highest home insurance rates in the nation due to its susceptibility to hurricanes and tropical storms, which significantly increase the risk for insurers.

- Louisiana: $7,809 per year

- Similar to Florida, Louisiana’s high rates are driven by the frequent hurricanes and flooding events that impact the state.

- Oklahoma: $5,858 per year

- Located in Tornado Alley, Oklahoma experiences frequent tornadoes and severe storms, leading to higher insurance premiums.

- Texas: $4,437 per year

- Texas faces multiple natural disaster risks, including hurricanes, tornadoes, and wildfires, which contribute to its high insurance costs.

- Mississippi: $4,482 per year

- Mississippi’s coastal location makes it vulnerable to hurricanes and flooding, driving up insurance rates.

- Colorado: $4,367 per year

- Colorado’s increasing wildfire risk and occasional severe weather events like hailstorms contribute to its high home insurance rates.

- Nebraska: $4,292 per year

- Located in Tornado Alley, Nebraska’s exposure to tornadoes and severe storms results in higher insurance premiums.

- Alabama: $4,281 per year

- Alabama’s coastal areas are prone to hurricanes, while the entire state experiences tornadoes, increasing the cost of home insurance.

- Kansas: $3,666 per year

- Kansas is also part of Tornado Alley, with frequent tornadoes and severe weather contributing to its high insurance rates.

- Arkansas: $3,662 per year

- Arkansas experiences a variety of severe weather, including tornadoes and storms, which leads to elevated home insurance costs.

- South Carolina: $3,410 per year

- South Carolina’s coastal location makes it susceptible to hurricanes, while inland areas face risks from tornadoes and storms.

- North Carolina: $2,327 per year

- North Carolina faces hurricane threats along its coast, as well as other severe weather events, contributing to its higher insurance premiums.

- Illinois: $2,245 per year

- Illinois experiences severe weather events, including tornadoes and thunderstorms, which drive up home insurance costs.

- Utah: $1,541 per year

- Utah’s insurance rates for homes are influenced by risks from wildfires and occasional severe weather events.

- Montana: $1,997 per year

- Montana faces risks from wildfires and severe winter weather, contributing to its relatively high home insurance premiums.

- Connecticut: $1,927 per year

- Connecticut’s coastal areas are vulnerable to hurricanes and flooding, leading to higher insurance rates.

- Nevada: $1,336 per year

- Nevada’s home insurance costs are impacted by risks from wildfires and occasional severe weather.

- Michigan: $2,095 per year

- Michigan experiences severe winter weather and occasional severe storms, driving up home insurance premiums.

- Maryland: $1,782 per year

- Maryland’s coastal location makes it susceptible to hurricanes and flooding, increasing the cost of home insurance.

- Minnesota: $2,524 per year

- Minnesota faces severe winter weather and occasional severe storms, contributing to its higher home insurance costs.

Recent Posts

2024- Are Burglary Claims Still a High Risk?

Burglaries are a persistent threat to homeowners across the U.S., with over one million break-ins occurring annually. Even though burglary rates have decreased...

2024 Atlantic Hurricane Season Predictions

All Early Predictions Call for a Busy 2024 Atlantic Hurricane Season Forecasters are predicting an exceptionally active Atlantic hurricane season in 2024. The...

Top High-Risk Home Insurance Factors

When you own a home, one of the most important things you need is home insurance. This insurance helps protect your house and...