"*" indicates required fields

Created in 1969 by the general assembly, the NCJUA or North Carolina FAIR Plan was established to provide an adequate market for homeowners insurance and encourage property owners to make improvements within the state of North Carolina. Although not a facility of the North Carolina State Government, the Plan of Operation is subject to review and approval by the North Carolina Department of Insurance.

The North Carolina FAIR Plan offers to any person with an insurable interest in a North Carolina property, full peril dwelling and commercial building insurance within the state’s boundaries except for the beach area which is considered to be the area that lies south and east of the inland waterway including the area known as the Outer Banks.

The North Carolina Fair Plan is defined by state statutes as a “Market of Last Resort” and it is highly recommended that property owners attempt to obtain insurance in the private marketplace. Most consumers use the FAIR Plan when they have been unable to obtain coverage in the private market due to home insurance claims and have been labeled “high risk.”

The products offered within the FAIR Plan are:

Dwelling Fire (available in all territories except for the Beach Area)

Commercial Fire (available in all territories except for the Beach Area)

The dwelling and commercial plans offer coverage for windstorm and other perils like fire, lightning, vandalism and malicious mischief. Coverage can be written on a replacement cost basis or actual cash value.

The maximum limits for coverage is as follows:

Residential buildings $750,000 and personal property capped at 40% of the dwelling

Commercial combined limits of $2.5 million, capped at $6 million aggregate

Coastal Property Insurance Pool (CPIP)

Formerly known as the Beach Plan, the CPIP (part of the North Carolina FAIR Plan) was created in 1969 by the general assembly to provide an adequate market for property insurance for properties located in the beach and coastal areas of NC. The CPIP offers commercial and homeowners insurance for those properties located in the 18 eligible coastal counties of North Carolina. It also is a market of last resort and property owners are encouraged to shop the private market before attempting to obtain coverage in the Coastal Property Insurance Pool.

As with all FAIR Plans, consumers are urged to try to find coverage in the private market and we can help you find an agent that can help you find alternatives to the FAIR Plan.

Recent Posts

2024- Are Burglary Claims Still a High Risk?

Burglaries are a persistent threat to homeowners across the U.S., with over one million break-ins occurring annually. Even though burglary rates have decreased...

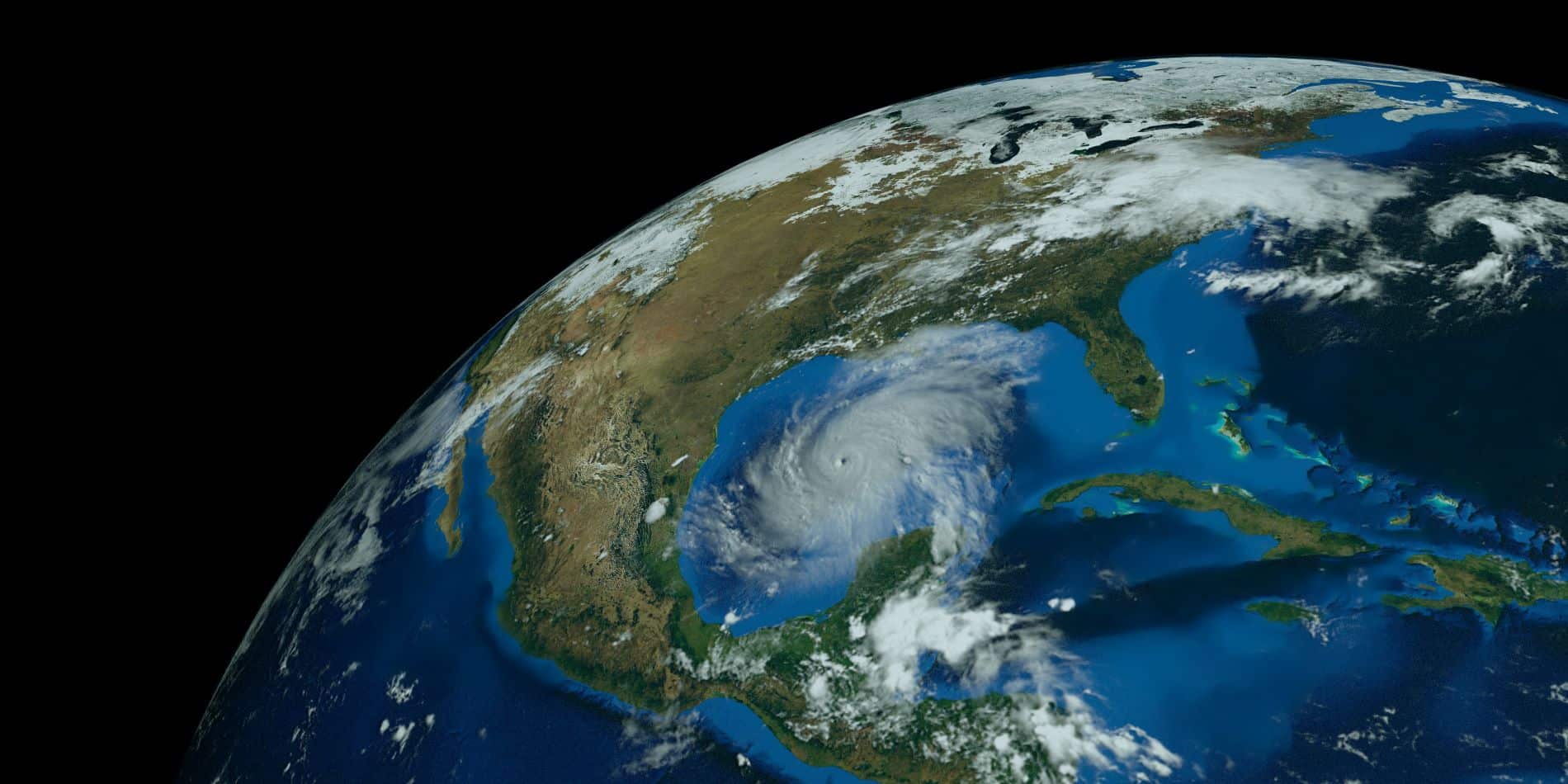

2024 Atlantic Hurricane Season Predictions

All Early Predictions Call for a Busy 2024 Atlantic Hurricane Season Forecasters are predicting an exceptionally active Atlantic hurricane season in 2024. The...

Top High-Risk Home Insurance Factors

When you own a home, one of the most important things you need is home insurance. This insurance helps protect your house and...